net investment income tax 2021 proposal

Changes to Estate and Gift Taxes. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

. Applying the net investment income tax. Reduction in QSBS Benefits. The pass-through rate would essentially be the 396 individual rate plus 38 NIIT plus 3 surtax on income over 5m creating a.

Net investment income includes interest dividend annuity royalty and rental income unless those items were derived in the ordinary course of an active trade or business. July 21 2021. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec.

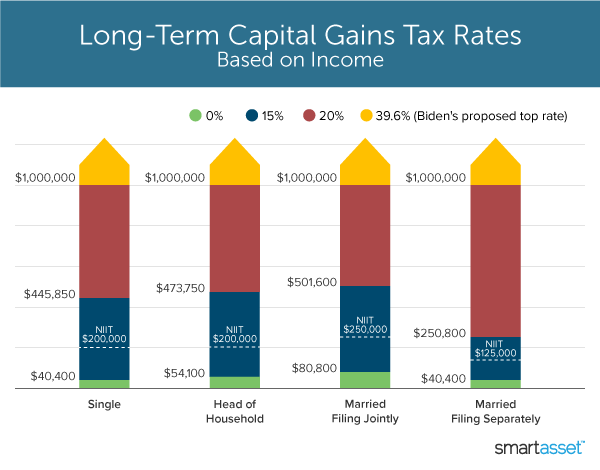

This proposal would be effective for tax years beginning after Dec. The proposal would increase this rate from 20 percent to 25 percent and effective for tax years beginning after December 31 2021 lower the income thresholds to which this top rate applies. An additional surtax of 3 would be applied to modified adjusted gross income exceeding 5000000 2500000 for married taxpayers filing separately.

Net Investment Income Tax NIIT presents a big planning opportunity. 38 MEDICARE TAX STILL APPLIES MORE BROADLY AND OTHER UNFAVORABLE CHANGES FOR SMALL BUSINESSES. Net investment income includes interest dividend annuity royalty and rental income unless those items were derived in the ordinary course of an active trade or business.

The House proposal. Net investment income can be capital gains interest or dividends. Enacts a 5 surtax on modified adjusted gross income over 10000000 and an additional 3 surtax on modified adjusted gross income over 25000000 versus a 3 surtax on incomes above 5000000.

250000 for married filing jointly or qualifying widow er 125000 for married filing separately. Expansion of the net investment income tax NIIT to cover net investment income from non-passive activities for taxpayers with greater than 400000 single or 500000 joint as well as for trusts and estates. The plan would reduce the tax benefit for those earning above 80250 but under 400000 violating Bidens tax pledge to not raise taxes on earners below the 400000 threshold.

Net Investment Income Tax NIIT presents a big planning opportunity. However some profits namely those of S corporations arent subject to the 38 net investment income tax which was created by the Affordable Care Act to fund Medicare expansion. The proposal would increase the top marginal individual income tax rate to 396.

Here are some of the key tax provisions. Net Investment Income Tax Expansion. The BBBA would also retain the WM Proposals changes to materially limit the benefits for owners of qualified small business stock QSBS.

Nearly all of the changes we saw in the September 13th tax proposal are gone. This rate would apply to taxable income exceeding the 2017 top bracket threshold adjusted for inflation. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that applies to you.

Senator Wydens proposal removes the specified service trade or business and W-2-wagecapital investment limitations but phases out the deduction. The limit of the Section 199A deduction in the bill is not as restrictive as that proposed by Senate Finance Committee Chairman Ron Wyden D-OR in the Small Business Tax Fairness Act introduced in July 2021. Reform of individual income tax.

The proposal would reduce the 75 and 100 exclusion rates for gains realized from certain qualified small business stock QSBS to 50 for trusts estates and taxpayers with adjusted gross income of 400000 or more. One of Bidens tax proposals that has gotten little attention is a change that would shift the benefits of tax deferral in traditional retirement accounts toward lower- and middle-income earners. Increase in the top marginal individual income tax rate.

The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that applies to you. This would apply to sales and exchanges after September 13 2021 subject to a binding written contract exclusion. The 2021 estate tax exemption threshold is 117 million per individual indexed for inflation with a top tax rate of 40 percent.

These individuals are also exempt from the 38 Medicare or net investment income tax NIIT which currently applies only to certain passive income and gains. Note that these income levels apply to many of the changes discussed below so for simplicitys sake we will just call these taxpayers the High Income Taxpayers. The AFP was introduced via a press release from the White House on April 28 2021 and includes several provisions to increase federal funding of education and health care which would be funded by tax increases.

The proposal would be effective for tax years beginning after December 31 2021. Income and Investments. A separate proposal would first increase the top ordinary individual income tax rate to 396 434 including the net investment income tax.

We can forget about updated tax brackets the 25 maximum capital gains rate the refundable child tax credit extension past 2022 the death of the back door Roth and the defective grantor trust and. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service. Proposals under the AFP include raising the top marginal tax rate.

Increases the top income tax rate to 396 on taxable income above 400000 for individuals and 450000 for joint filers. The excess of modified adjusted gross income over the following threshold amounts. Fortunately there are some steps you may be able to take to reduce its impact.

However due to certain complexities in the. 1 It applies to individuals families estates and trusts but certain income thresholds must be met before the tax takes effect. The top individual tax bracket remains 37 versus an increase to 396.

The Biden Administration believes that the NIIT reflects an intention to impose the 38 tax on both earned and unearned income of high-income taxpayers. The net investment income or. Increasing the capital gains tax rate.

All other threshold amounts are NOT indexed for. Increasing marginal tax rates. Warrens Ultra-Millionaire Tax Act would implement an annual 2 percent tax on wealth over 50 million and a 3 percent tax on wealth that exceeds 1 billion.

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. The proposal would generally be effective for tax years ending after September 13 2021 and thus generally would be effective from January 1 2021 for calendar year taxpayers. Trusts and estates will be subject to lower thresholds.

200000 in all other cases. In the case of an individual the NIIT is 38 percent on the lesser of. For individuals owning qualifying businesses the proposed limitation of this preference would raise rates by 40.

What Is The The Net Investment Income Tax Niit Forbes Advisor

The Return Of The Dividend Recap Northern Trust

What S In Biden S Capital Gains Tax Plan Smartasset

Tax Facts On Individuals 127th Edition Ebook In 2021 Business Ebook Small Business Accounting Facts

Training Request Form Template

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Follow Steve Rosenthal S Stevertax Latest Tweets Twitter

Like Kind Exchanges Of Real Property Journal Of Accountancy

Simple Profit And Loss Statement Check More At Https Nationalgriefawarenessday Com 6555 Simple Profit And Loss Statement

Free Editable Startup Funding Proposal Template Word Template Net

Biden Budget Biden Tax Increases Details Analysis

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Income Tax Law Changes What Advisors Need To Know

How To Read Your Income Statement Like An Accounting Pro

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning